The Future of Shopping: What Are POS Funding Platforms?

Consumer habits are changing. With the increase in shopping on the Internet - there must also be changes in payment methods. What does this mean for the fintech industry?

Buying on deferred payment is nothing new: buying on installments, taking out a loan, buying with a credit card, paying by check - everyone has bought something this way at some point.

But one thing that has been noticed in recent years, especially among younger generations, is the avoidance of using credit cards and the increase in purchases based on the principle of "buy now, pay later" or BNPL - Buy now, pay later.

What is the difference?

BNPL makes shopping online or in-store (on-site) easier – installments are easier to repay and are often interest-free, or have very low interest rates.

They are especially useful for people who find it difficult to get credit, such as young people who find it difficult to get their first loan approved because they have no history with the credit bureau. This way, customers can make a purchase immediately, without fear of hurting their household budget. Even so, they have control over how much and when they will pay.

Because of this, POS financing has become one of the most popular areas in fintech, with more than $500,000,000 invested in just the last 6 months.

One of the companies developing a platform for POS financing is Leanpay - a startup that allows users to get loans on the spot for certain purchases from sellers, which they pay back in several monthly installments.

Leanpay consists of a multidisciplinary team of professionals from trade, banking and fintech software development. They operate successfully in the markets of Slovenia and Croatia, and in the course of 2022, they plan to expand to two more markets.

Why are POS financing platforms necessary?

In addition to the fact that an increasing number of users are leaning towards the BNPL way of shopping - which means that they are necessary for sellers to remain competitive in the market, POS platforms simplify the entire process, both for buyers and sellers.

From the customer's perspective, the process is greatly facilitated by the fact that everything takes place within the platform. Customers choose the level and speed of repayment by choosing the number and amount of installments.

For example, customers through the Leanpay platform can choose whether their goal is to pay off their purchase quickly (within 3 months) or to have their installments as low as possible (pay off the purchase within 48 months). If they meet all the conditions, they get approval for the purchase on the spot.

In this way, it is easier for customers to make a decision about larger purchases, because it gives them the freedom to choose the method of repayment that suits them, according to their capabilities.

Therefore, the benefits of this method of purchase are also seen by sellers - more options for payment means an increase in sales, but also a better user experience.

However, the biggest benefit of end-to-end POS platforms for retailers and financial institutions is that they have a ready-made payment solution – they don't have to develop their own.

What should a POS platform contain?

In order to better understand what a POS platform entails, we will explain using the example of Leanpay.

The Leanpay platform enables the automatic connection of the buyer (user) and the seller (vendor) when purchasing in installments (online or in a store).

The key entities in this installment purchase process are the customer (user), the vendor (vendor) and the Leanpay platform. Specific segments of the Leanpay platform allow the aforementioned entities to communicate and collaborate.

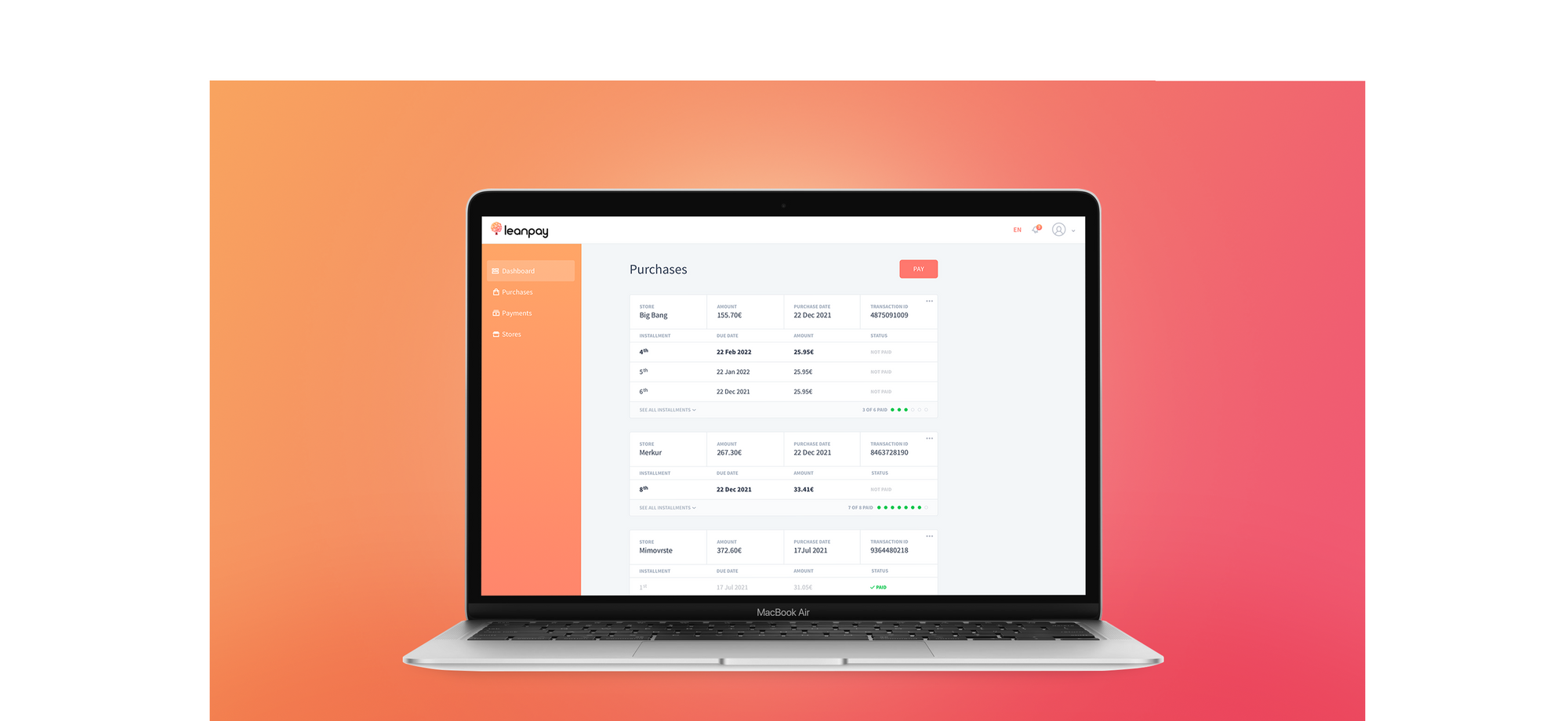

The segment related to customers is a web client application (Angular), in which the user can monitor his loans, current total debt, documentation, and notifications, as well as have insight into his profile as a whole.

The web application for vendors (Angular) and technical integration (e.g. server to server integration) with the Leanpay platform is a part of the Leanpay platform that allows the seller to track all their sales in installments, with overall analytics.

This application also enables vendors who do not have an online shop to enable customers to purchase via the Leanpay platform, that is, to create an installment purchase offer for potential customers on the spot, in the sales facility itself.

New market - new challenges

After the success achieved in the Slovenian market, Leanpay expanded its operations in Croatia last year, and this year it is the turn of Romania and Hungary.

The development of POS platforms is challenging from several different aspects, one of which is adapting the platform to different markets. Although many people think that all European Union markets are the same - the truth is completely different.

Each market has its own peculiarities, which are not only reflected in consumer habits but also in regulations, which are not fully harmonized.

Leanpay's goal is to provide the same core value in all markets - the best user experience for users.

What does that mean?

The user experience within the POS platform does not end only within the user's interaction with the application (to make the application logical and easy to use), but includes the entire life cycle of the application.

From the moment the user hears about Leanpay, through the very moment of purchase, identification (KYC), delivery of goods and, of course, payment of the installment - every step is important.

It is also necessary that they constantly work on developing the necessary APIs and improving e-commerce plug-ins in order to achieve the simplest possible integration with market partners who use their solutions.

Fintech - following trends or creating new ones?

The development of POS platforms is only a small part of the changes that will follow the further development of various fintech solutions. Although we are already seeing big changes in how we manage our money – with the arrival of blockchain and cryptocurrencies, the changes are just beginning.

What is certain is that users increasingly value their newfound freedom in managing their finances. Innovations in fintech make this possible, and in what direction the innovations will take place and how sellers and buyers will adopt them, we have yet to see.

Are you interested in fintech and want to work on solutions that will shape the future of shopping? View active Leanpay ads on Joberty and apply today!